As we head into the new week, I think that we are going to be held hostage to the interest rate markets. The biggest issue that a lot of people are not paying attention to is that something has fundamentally changed. The era of cheap and easy money is over. This is going to have a major impact on trading, as well as the real world. The cost of everything is going to continue to go higher, and quite frankly, most central banks have no good choice. The profligate spending has finally gotten to the point where painful choices have come home.

The spread

When you look at the interest rates around the world, they are all moving higher – in general. The most reported one was of course the interest rates in the United States. The biggest reason it matters so much in the case of the USA is that a lot of debt around the world has been financed in US dollars. So think of this potential doom loop: A corporation or country borrows in US dollars. This decision was made because the USD is by far the most widely used currency, and you could borrow at extremely cheap levels. However, as the rates start to climb, it causes the USD to appreciate.

If you are that company/country, your local currency is now falling in USD terms. So, let’s say that your currency lost 10% against the USD. It now costs at least 10% more to pay off that debt. These companies/countries will have inputs from their local economy in that currency that is now losing strength. This becomes a major issue, and only gets worse as the scramble for dollars perpetuates. Some of these countries and companies are trying to hedge costs by purchasing those dollars. Furthermore, most commodities – including food – is also priced in dollars.

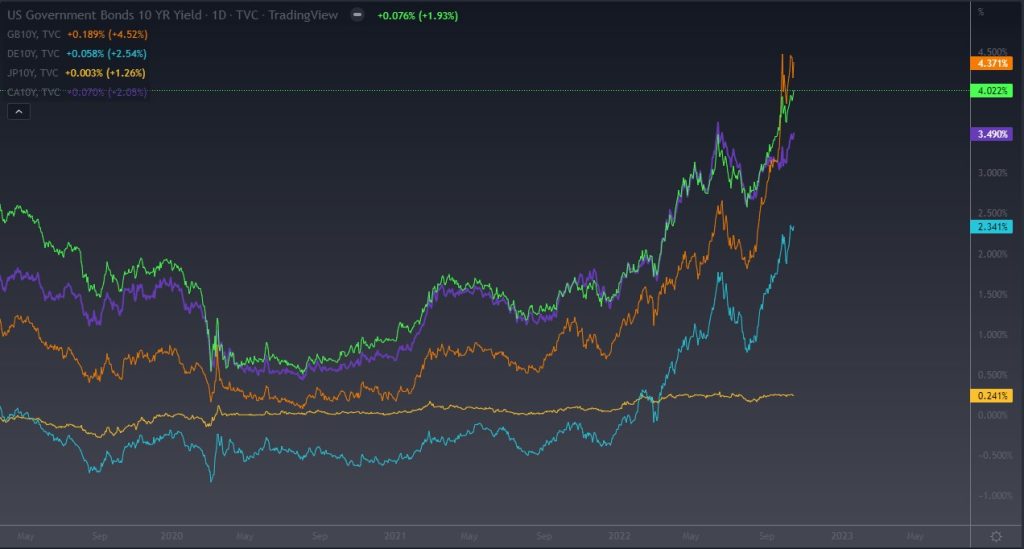

So now that we have talked about the spread, you can look at the chart above. The rates are all going higher, except Japan. (More on that in a moment.) However, notice that not all rates are equal. The green line, USA, is much higher than Germany, Aqua. This is one of the simplest ways to appreciate the USD strength over the Euro lately. However, you also recognize that there are a lot of major problems in the EU that are also sending money out of the region. Although the rates are all rising, the fact is that a lot of the action in the FX markets are not just about rates, but that’s the baseline.

Japan has no good choices

Japan has no good choices. When you look at the rate charts, you can see that the 10 year yield in Japan, shown in yellow, has essentially gone flat. This is a result of the Bank of Japan intervening to keep rates under 0.25%. They accomplish this by buying an “unlimited amount of bonds.” When a central bank buys bonds, it is creating money. In other words, this is the same thing as “printing money.” The more money flooding into the system – the less desirable it is from a supply and demand situation.

This can be seen in the depreciation of the Japanese yen this year. This is a situation where the bank has decided they must keep rates down. Have of 2022, Japan has a debt-to-GDP ratio of 266%, and a shrinking population. In other words, it is likely that the Japan will never pay it all off. Below is a chart that shows the major currencies around the world, and their percentage returns against the Yen since 2021. You will notice the massive shot higher in early 2022, and just how much destruction has been done to the Yen. In other words, it is clear that the Bank of Japan can either have a weak currency, or low rates.

Because of what we have seen, something is going to break. There will be careers to be made if the Bank of Japan every allows rates to rise, as the “catch up trade” gets kicked off. However, with Kuroda just recently reiterating the BoJ’s desire to fight rising rates, it is still going to be a situation where the Yen gets pummeled. Furthermore, the rates rising they way they are also works against the other asset classes around the world, especially stocks.

You should keep an eye on the rate markets, it will lead the way. It looks like we can expect more of the same going forward this week and beyond.

Chris