The Gross Domestic Product (GDP) and the foreign exchange market (Forex) play crucial roles in any country’s economy. GDP measures the value of all goods and services produced within a country, while Forex is where currencies are bought and sold. The connection between GDP and Forex is significant, as changes in one can have a profound impact on the other.

GDP serves as a key indicator of a country’s economic well-being. A high GDP signifies robust production of goods and services, along with increased earnings for individuals. A strong GDP often corresponds to a robust economy, which can result in a stronger currency. When a country boasts a high GDP, it tends to attract foreign investment, driving up demand for its currency and making it more valuable.

Conversely, a low GDP indicates a decrease in the production of goods and services, leading to lower earnings. In such cases, the currency may weaken, as foreign investors are less inclined to invest in a struggling economy. Low GDP can also contribute to inflation, which can erode the currency’s value.

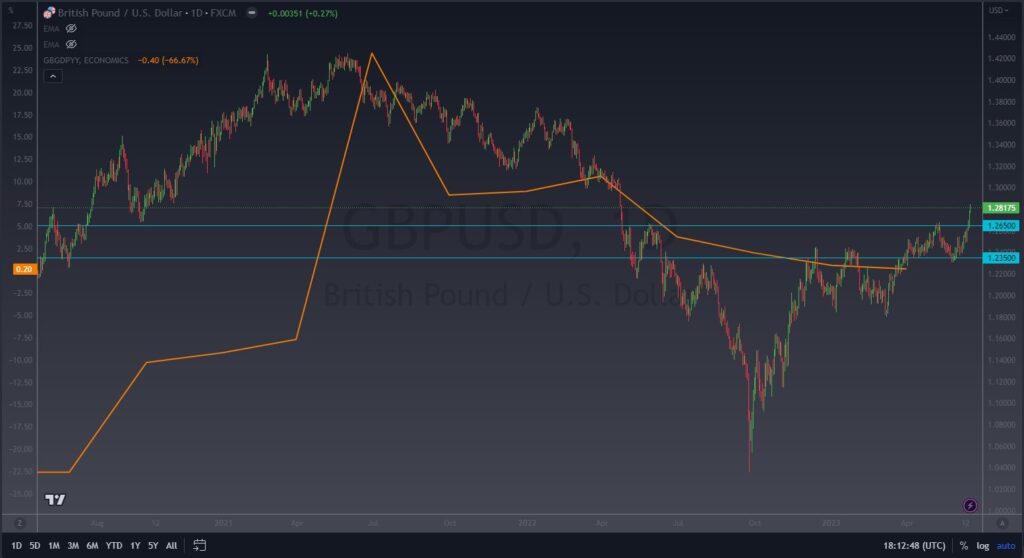

Beyond the overall level of GDP, the growth rate of GDP is also influential in the Forex market. If a country’s GDP is expanding at a faster pace than its trading partners, its currency may appreciate against theirs. This is because investors are more likely to invest in a country with a thriving economy, anticipating an increase in the currency’s value over time.

Conversely, if a country’s GDP growth rate lags behind that of its trading partners, its currency may depreciate relative to theirs. Investors are less inclined to invest in a country with slower economic growth, believing that its currency will lose value.

However, it’s important to acknowledge that the relationship between GDP and Forex is not always straightforward. Numerous other factors can influence currency value, including interest rates, political stability, and inflation. For instance, even if a country exhibits a high GDP, if its political climate is unstable or inflation is high, its currency may still weaken.

Additionally, the impact of GDP on Forex can vary depending on a country’s economic structure. Export-oriented countries may benefit from a weaker currency, as it makes their goods and services more affordable to foreign buyers. On the other hand, import-oriented countries may benefit from a stronger currency, as it reduces the cost of imported goods for their citizens.

To summarize, GDP is a critical gauge of a country’s economic health, and changes in GDP can significantly influence Forex. A robust GDP generally corresponds to a strong currency, while a weak GDP can lead to a currency’s depreciation. Nevertheless, the relationship between GDP and Forex is multifaceted, with other factors coming into play. Investors and traders must consider a range of economic indicators when making investment decisions in the Forex market.