When it comes to trading Forex, the most important currency to get correct is almost always going to be the US dollar. After all, it is the world’s reserve currency, and often seen as a “safe haven” when times are tough. When you trade major pairs, the one thing that they all have in common is the “USD” part of the exchange rate. In other words, if you know where the USD is going, it tells you where so many pairs are going as well.

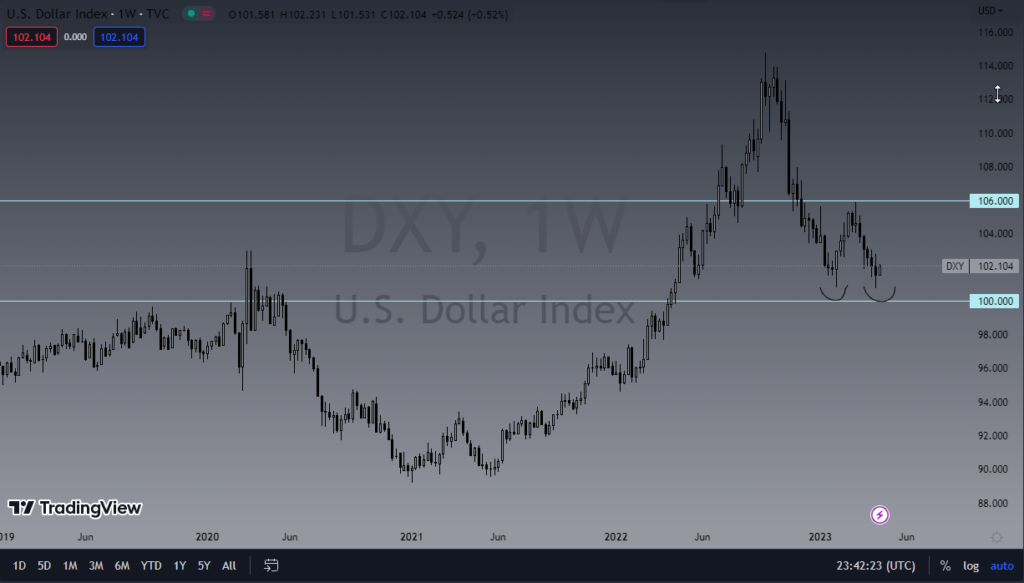

The DXY – US Dollar Index – looks as if it is trying to form a but of a “double bottom” just above the 100 level, a key psycholgoical figure. Because of this, I assume that the greenback could have a bit of a recovery in the short-term at least. As you can see on the chart below, I have the weekly timeframe shown, and I believe we are about to bounce to try to get back to the crucial 106 level. This is an area that has been like a magnet multiple times. In short, I think that the USD is about to strengthen against a lot of currencies, especially those “riskier ones.”